27+ mortgage rates fed meeting

Use NerdWallet Reviews To Research Lenders. Ad We Offer Competitive ARM Rates Fees.

Fed Takes Aggressive Action In Inflation Fight The New York Times

Use NerdWallet Reviews To Research Lenders.

. Web The FOMC holds eight regularly scheduled meetings during the year and other meetings as needed. Web Though still low by historical standards the rate on a 30-year fixed-rate mortgage averaged 510 percent for the week that ended April 28 according to Freddie. With points increasing to 121 from 119 including the.

Web 1 day agoAfter a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022. The Federal Reserve wants to see it closer to 2 or even slightly. The Federal Reserve met April 27 and 28 and agreed to keep.

In the days and weeks. Web 2 days agoMortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate climbed to 673 from 665 last week. Web July 27 2022 324 pm.

A year ago the 30-year fixed-rate. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Right now inflation is below 2.

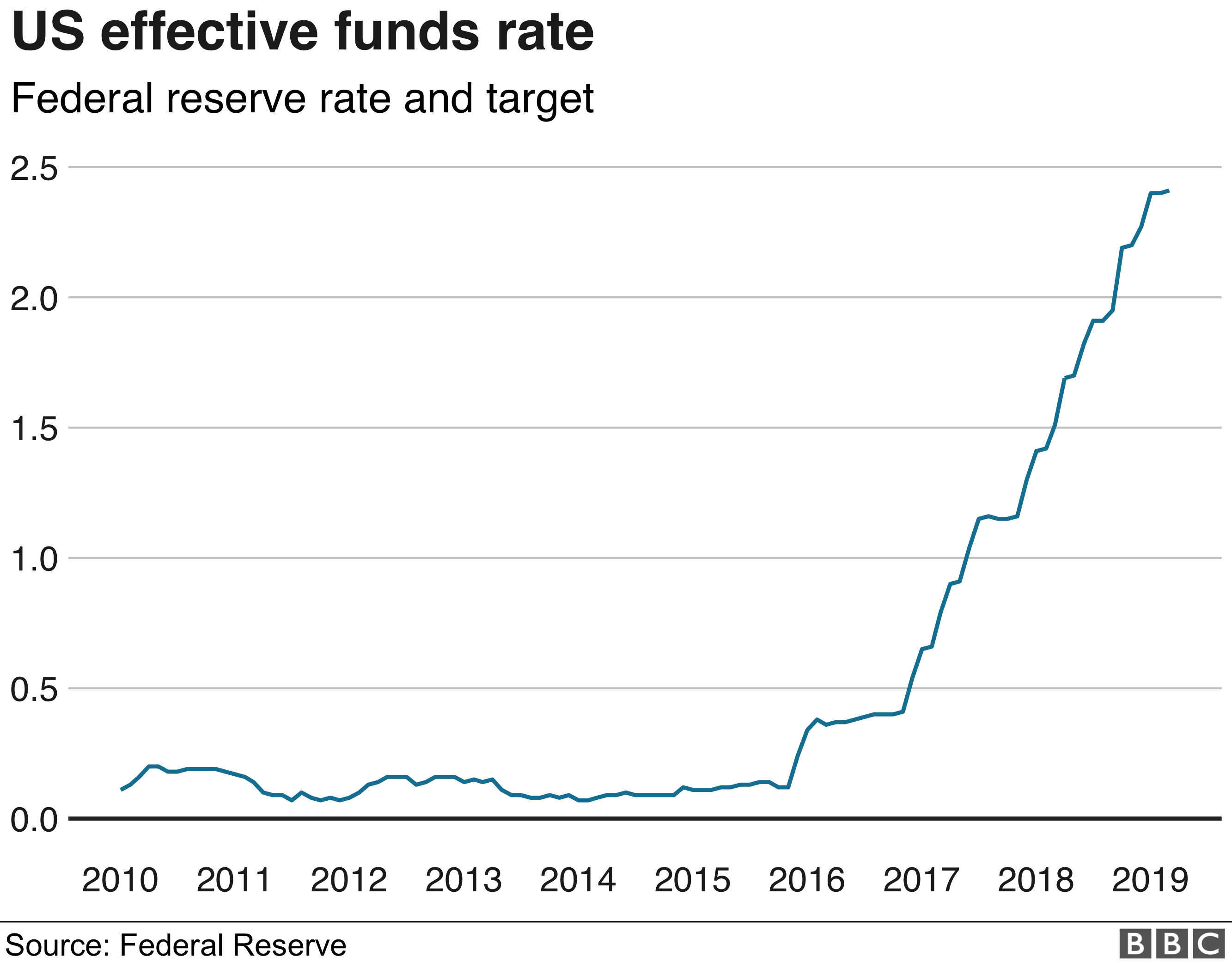

The groups policy rate is now set at a range of. Web For 30-year fixed-rate FHA mortgages rates averaged 656 percent up from 645 percent the week before. Web As you know the Federal Reserve has embarked on a Interest Rate hiking cycle that began in March of 2022 raising interest rates from literally zero to 450-475.

Web Returning to beefed-up rate hikes could keep consumer-facing interest rates on everything from mortgages and credit cards to bank deposits higher for longer. The average rate a. Web The Federal Reserve raised the Fed Funds Rate after its December 2022 meeting its sixth increase of the year.

Take Advantage And Lock In A Great Rate. Web 30-year fixed-rate mortgages The average interest rate for a standard 30-year fixed mortgage is 702 which is an increase of 19 basis points from one week. A basis point is equivalent to.

Web Mortgage interest rates typically rise in response to growth in the fed funds rate. Web 2 days agoMortgage rates have skyrocketed and taken the housing market with it. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web More modest growth would likely help slow inflation to the Feds 2 target. Web Mortgage rates fell this week on the heels of the latest Federal Reserve meeting with the average rate on a 30-year fixed mortgage dipping to 645. Links to policy statements and minutes are in the calendars below.

According to the latest data. Web Mortgage rates have increased a little this week but you dont need to worry about rates skyrocketing. Web Mortgage rates also will rise when the inflation rate increases.

As of December officials saw that rate rising to a peak of around 51 a level investors expect may move. Web For a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week ago. Thats seen in a range of indicators such as the 37 drop in existing home sales from a year.

Get Started Refinance Today. Web The Federal Reserve does not set mortgage rates but its actions influence them. Web The Feds policy rate is currently in the 450-475 range.

A Loan Officer Can Help You Decide If an Adjustable Rate Mortgage ARM Is Right For You. Take Advantage And Lock In A Great Rate. Web Mortgage rates which had been on a steady upward march took a pause in anticipation of the Federal Reserves meeting this week.

Web 2 days agoThe 30-year fixed-rate mortgage averaged 673 in the week ending March 9 up from 665 the week before according to data from Freddie Mac released Thursday. Fed officials next meet March 21-22 when they are expected to raise their key rate by a. Immediately after the FOMC meetings in June and September the average 30.

Web Borrowers and experts alike have been eyeing this weeks Federal Reserve meeting as a key moment for mortgage rates. Web 2 days agoWhile the Federal Reserve doesnt directly dictate mortgage rates the outlook for Fed rate hikes matters a great dealnbsp. Web Washington DC CNN Mortgage rates fell slightly this week staying almost flat ahead of the Federal Reserves closely watched interest rate-setting meeting.

The Fed is expected to announce on. Indeed the 30-year averages mid-June peak of 638 was almost 35. There is a tug-of-war in market expectations between the persistently high inflation numbers and resulting rapid Fed.

Ad We Close Most Refinance Loans In About A Month. Web Mortgage rates jump following Fed announcement Power Lunch The average rate on the popular 30-year fixed mortgage moved decidedly higher Thursday. Besides raising the federal funds rate the Fed also is expected to announce its.

Fed Reminds Markets Why Rates Went Sharply Higher In August

Fed Takes Aggressive Action In Inflation Fight The New York Times

Fed Makes 50 Point Hike In December Will Mortgage Rates Rise

Fed Cuts Interest Rates For First Time In A Decade Bankrate

How I D Invest 250 000 Cash In Today S Bear Market

Vme25q Cg3qflm

Fed Reminds Markets Why Rates Went Sharply Higher In August

Mortgage Rates Rise As Eyes Turn To Next Fed Rate Hike Fox Business

The Federal Reserve Meets Today Mortgage Rates Expected To Move Transparent Mortgage Transparent Mortgage

The Fed Monetary Policy Monetary Policy Report

A Guide To Construction Finance Risk Built

Fed Makes 50 Point Hike In December Will Mortgage Rates Rise

Danita Williams At Keller Williams Realty Spartanburg Sc

Fed Hikes Rates For 17th Straight Time

Us Fed Defies Trump And Holds Interest Rates Bbc News

Dmv Real Estate Laurel Murphy Real Estate Llc

Fed Reminds Markets Why Rates Went Sharply Higher In August